The history of US foreign policy is punctuated by a series of doctrines. The Monroe doctrine (1823) declared that European powers would not be allowed to intrude into the western hemisphere. The Truman doctrine (1947) committed Washington to assisting free peoples in the fight against communism. The Nixon doctrine (1969) warned that America’s allies would need to assume primary responsibility for their own defence.

Does Bush’s Iraq policy satisfy the George Costanza criterion? Post a question now for Michael Fullilove

In recent times US grand strategy has been guided by a new kind of doctrine, named after not its author but its exemplar: the Costanza doctrine.

This doctrine, which had its heyday in 2002-2004 but remains influential, recalls the classic episode of the TV comedy Seinfeld, “The Opposite”, in which George Costanza temporarily improves his fortunes by rejecting all the principles according to which he has lived his life and doing the opposite of what his training indicates he should do. As Jerry tells him: “If every instinct you have is wrong, then the opposite would have to be right.”

Emboldened, he tries a counter-intuitive pick-up line on an attractive woman: “My name is George. I’m unemployed and I live with my parents.” At the end of their date, when she invites him up to her apartment, he demurs, cautioning that they do not know each other well enough. “Who are you, George Costanza?” the lady asks. Replies George: “I’m the opposite of every guy you’ve ever met.”

The Iraq policy pursued by the Bush administration satisfies the Costanza criterion: it is the opposite of every foreign policy the world has ever met.

The Costanza doctrine is most closely associated with President George W. Bush and his first-term confidants: the wild-eyed neo-cons and the dead-eyed ultra-cons. But there is a wider group, which includes most presidential candidates and many of Washington’s foreign policy elite, who are not fully paid-up subscribers to the doctrine but went along with it nonetheless. Allied governments in London, Madrid and Canberra also signed up.

In “The Opposite”, George breaches the most fundamental laws in his universe – for example, the age-old principle that “bald men with no jobs and no money, who live with their parents, don’t approach strange women”.

Similarly, in its geopolitical incarnation, adherents to the Costanza doctrine cast aside many of the fundamental tenets they learnt at staff college or graduate school. Let me name a few.

First, military and diplomatic resources are finite and should be directed towards your greatest priority. An example of the opposite approach would be for a country that has been attacked by a non-state terrorist group to retaliate by removing a state regime that had nothing to do with the attack.

Second, take care not to weaken your intimidatory powers through poor military performance. Aim for short, sharp victories (such as that in the 1991 Gulf war) that get your adversaries worrying about the extent of US power. The opposite would be to launch a war of choice involving the drawn-out occupation of an Arab country – the kind of thing that gets your allies worrying about the limits of US power.

Third, you get by with help from friends. Although the powerful are sometimes tempted to go it alone, international support helps determine the perceived legitimacy of an action, which affects its risk and costs. Building this support requires discussion and compromise. The opposite would be to spurn real negotiations, slough off your allies, bin multilateral agreements you do not like and declare that you are not bound by the rules that govern everyone else.

Fourth, state-building is hard. Few of the international efforts at state-building since the cold war’s end have succeeded. Luckily there are numberless reports identifying lessons learnt. The alternative would be to do the opposite of what those reports recommend, for example by deploying insufficient troops and dismantling any extant national institutions such as the army.

Fifth, democracy is a blessing that requires patient nurturing. The opposite approach would be to seek to impose democracy by force of arms on a population traumatised by decades of vicious and totalitarian rule.

Sixth, politics, like nature, abhors a vacuum. If two dangerous states are struggling for dominance of a strategic region, maintaining a balance between them may be the least worst option. The opposite would be to emasculate one of them, thereby greatly increasing the relative power of the other.

Finally, historians often cite the need for prudence in international relations, quoting the physician’s dictum: “First, do no harm.” The opposite would be: “Don’t think too much, just chance your arm and see what happens!”

There is a moment in “The Opposite” when George Costanza pre-empts some hooligans making a ruckus at the movie theatre: “Shut your mouths or I’ll shut ’em for ya. And if you think I’m kidding, just try me. Try me! Because I would love it!”

For a while, that kind of method worked – for both Georges. Then normal service resumed. The Costanza doctrine is all about hope, but when it comes to making your way, in New York or the world, experience is the better guide.

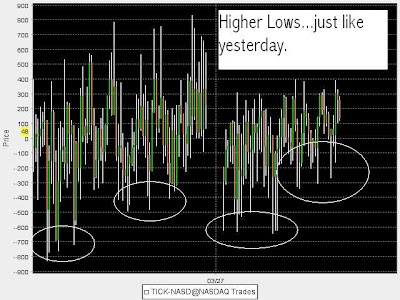

Just sitting down going through my records for March and if you followed YukTrader through this tumultuous month...drum roll please...you scored plus 92 points trading the Nasdaq futures...cheers and applause...

Just sitting down going through my records for March and if you followed YukTrader through this tumultuous month...drum roll please...you scored plus 92 points trading the Nasdaq futures...cheers and applause...