LunchTime Lurch

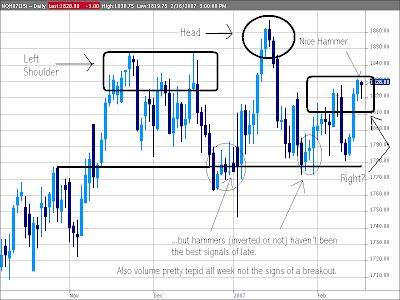

Markets relatively calm as both the S&P and NQ futures run into their resistance levels and turn tail.

Internals positive with advance decline lines 2-1 green on the NYSE and 1.5-1 on the "tech heavy" Naz. Up/down volumes almost 2-1 up on both exchanges

The blogosphere filled with opinions today as everyone and their mother thinking this or that...caution here and bottom there...

Interesting take from the first thing I read every morning...21stCenturyFutures...subscription required.

So now we have this crazy, distracting stock market crash being blamed on "China's stock market" which was never a really important factor in the US market. Around the world other markets fell but none as dramatically as the US....why?

Another factor in all of this which is really vital and damning is the now discovered BBC(British Broadcasting Corp.) broadcast DURING the 911 attacks. Their correspondent is standing in front of Building 7 reporting of it's collapse 23 MINUTES BEFORE IT COLLAPSED. Building 7, which has never gotten a plausable explanation for it's collapse/implosion, is clearly sitting in the background live while the BBC correspondent is reading the report of how it has collapsed.

Check it out for yourself. http://www.prisonplanet.com/articles/february2007/270207trustanything.htmTalk about shocking, rigged news and the media being involved with these type of staged events....this one takes the cake in my 30 years of investigating this kind of stuff. The last massive, outrageous crash we had was during the supposed British train bomb attacts by terrorists (the investigation of which has been avoided by the BBC). The market tanked hard in pre market and then turned around completely intraday and formed the bottom for the recent rally higher we just completed years later.

Check it out for yourself http://www.prisonplanet.com/articles/february2007/270207trustanything.htm

I rarely report about any of these type of things on the Morning Call anymore but I always do extra research whenever the markets make a strange move like the one we saw on Tuesday.

To have an edge in the market you have to see things that the general public does not recognize or consider in their analysis. Late last week we had "Crash Alert" signals, Bearish Market Force readings, and then an odd underlying shift to bullish for Tuesday but with the warning of some "out of left field" type news coming in.

I fear that all this may be a distraction for the combination of the Libby guilty verdict coming down anytime, the court transcripts being made public and enraging the US public even more against the administration and their "war policies" as well as the complicit news media in helping stage many of these events that trigger so called "random or coincidental" market moves.

My strongest concern is that an attack on Iran may be ordered anytime triggering World War III if the Russians and Chinese do not take kindly to such action and team up against the aggressors.

I do not know where this will send the stock market, but I wanted to let you know some of my inside research and where it might lead.

Now I don't usually go for this type of thing but there are so many odd angles to some of these earth shattering events that I am fully open to at least considering "alternative" thinking. A successful trader considers all the angles.

jfg.